Truck Driver Log Book: Mileage Log Book for Business and Taxes

731 Travel log entries + Truck Maintenance, Pre trip inspection & Fuel log

Paperback

Truckers log book for business and taxes manages. 731 Travel log entries / inspection log / repairs log / tires / gas consumption / 124 pages in total.

Print length

124 pages

Language

English

Publication date

February 01, 2024

Dimensions

8.5×11 in

🧐 The Ultimate Log Book for Truckers

Are you a truck driver striving to streamline your operations and ensure compliance with business and tax regulations? Look no further than our Truck Driver Log Book – the ultimate solution designed to meet all your logging needs.

😎 Drive Your Success with Our Truck Driver Log Book

Crafted with precision and attention to detail, our log book is your trusted companion on the road, providing comprehensive tracking of mileage, maintenance, inspections, repairs, fuel consumption, and more.

🌟 Key Features 🌟

😎 Efficient Organization

Our log book offers a structured layout for easy recording and retrieval of essential information, ensuring that all your trucking records are meticulously cataloged.

📚 Multiple Logs in One

With dedicated sections for mileage, maintenance, inspections, repairs, tires, and fuel consumption, our log book covers all aspects of your trucking journey in one convenient place.

📅 Date and Truck Identification

Easily track each entry with fields for date, truck number, departure, arrival, origin, destination, and odometer reading, providing accurate documentation for every trip.

💡 Purpose/Notes Section

Provide additional context for each entry, including the purpose of the trip, any maintenance or repairs performed, and insightful observations along the way.

✅ Truck Driver Log Book examples:

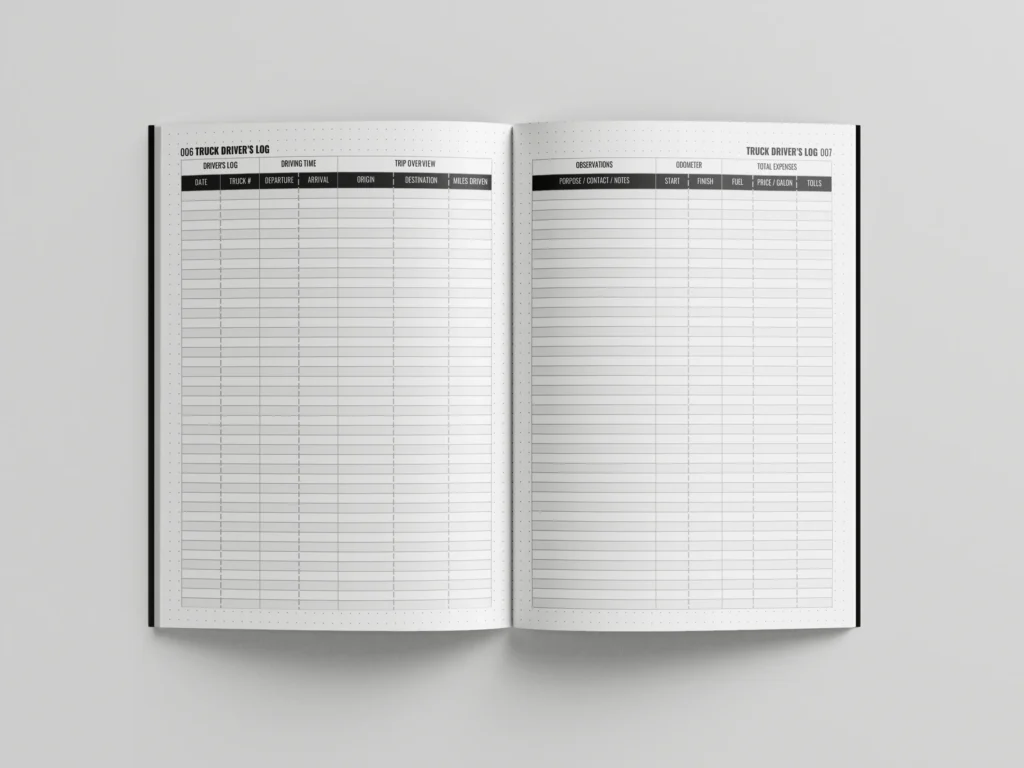

👉 Truck Driver Log

- Date

- Truck #

- Departure and Arrival Locations

- Driving time time

- Miles Driven

- Purpose/Notes

- Odometer Reading

- Fuel and Expenses

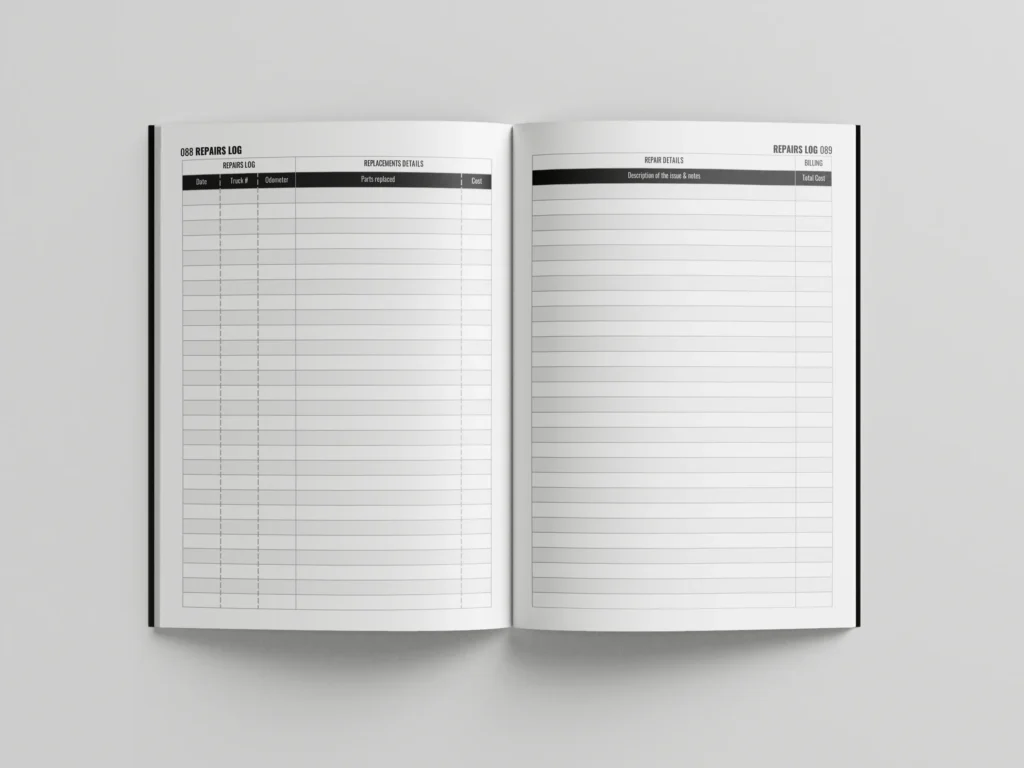

👉 Repairs Log

- Date

- Truck #

- Model

- Odometer Reading

- Mirrors

- Lights

- Wipers

- Brakes

- Engine Oil

- Fluid Levels

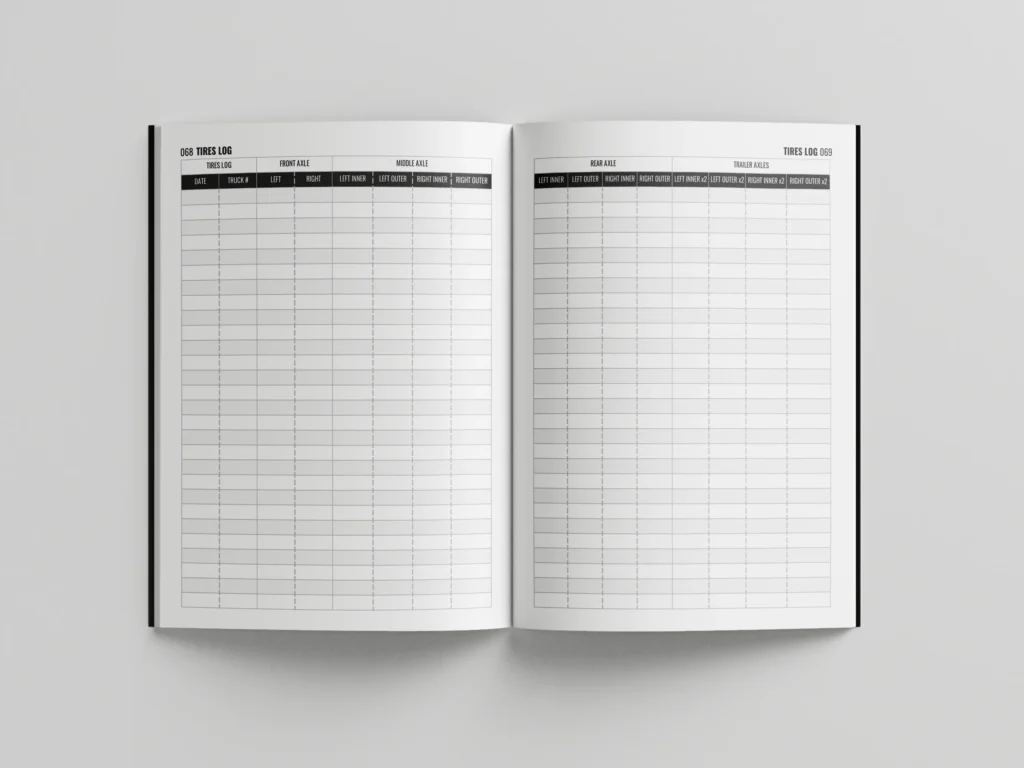

👉 Tires Log

- Date

- Truck #

- Front Axle Tires

- Middle Axle Tires

- Rear Axle Tires

- Trailer Axle Tires

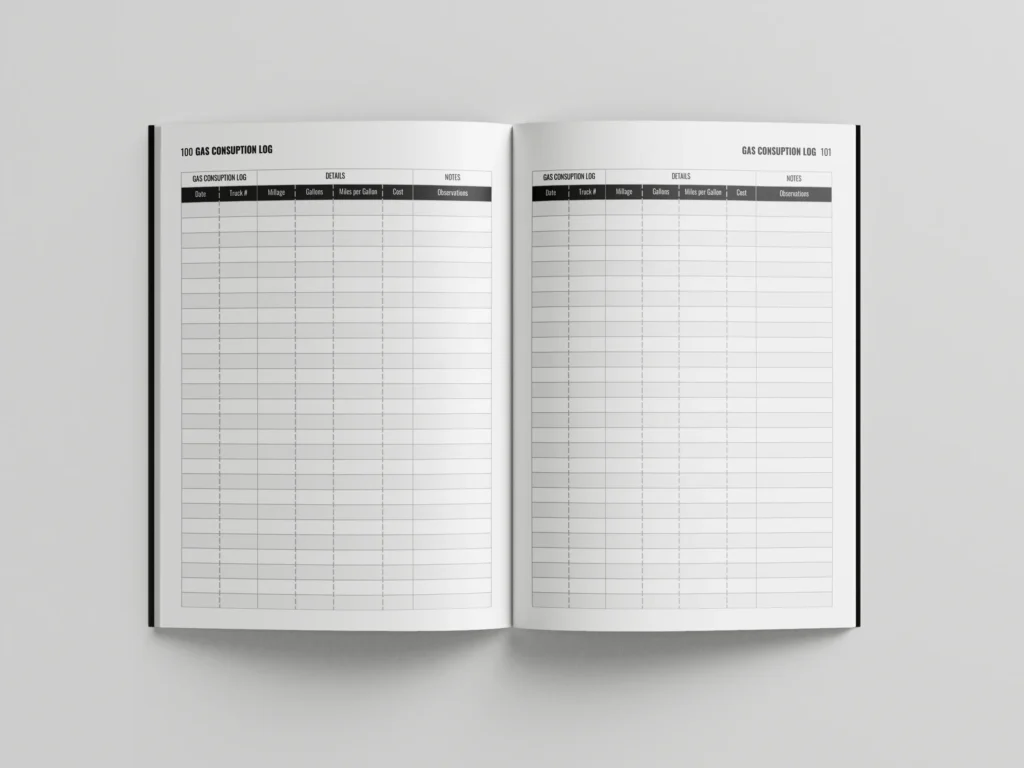

👉 Gas Consumption Log

- Date

- Truck #

- Mileage

- Gallons

- Mileage per Gallon

- Cost

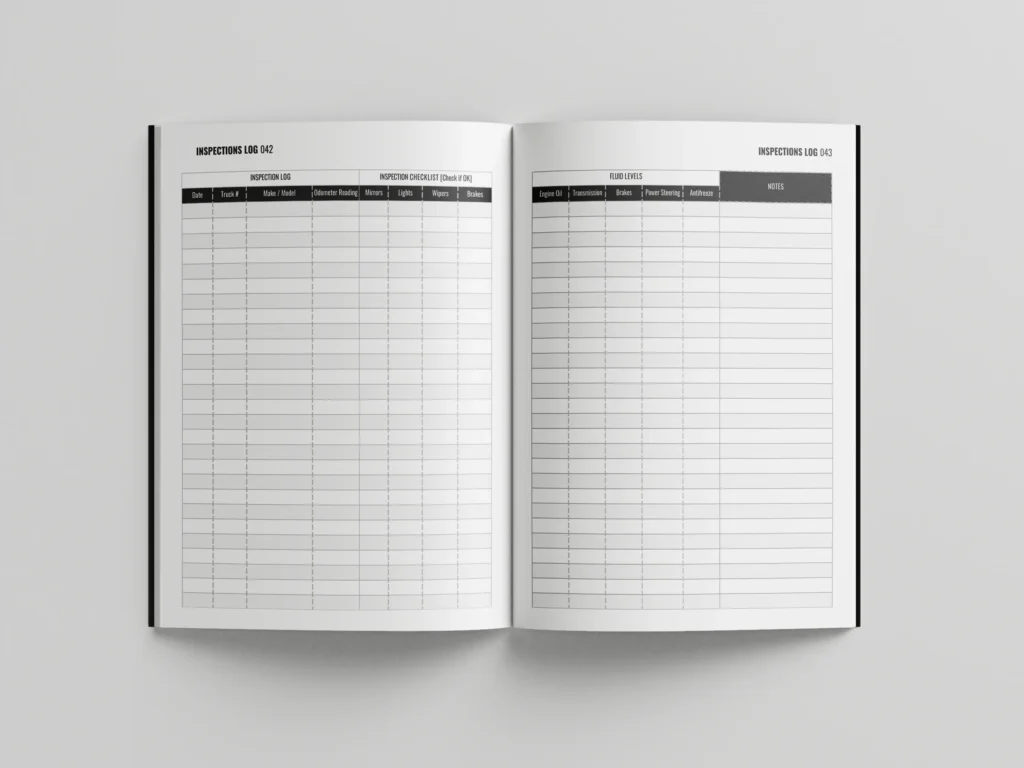

👉 Inspections Log

- Date

- Truck #

- Make/Model

- Odometer Reading

- Mirrors

- Ligths

- Wipers

- Brakes

- Fluis Levels

⚡ Why Choose Our Truck Driver Log Book? ⚡

- ✅ Efficiency: Streamline your record-keeping process and save time on administrative tasks.

- ✅ Compliance: Ensure that you meet all regulatory requirements and maintain accurate records for tax purposes.

- ✅ Organization: Keep all essential information in one centralized location for easy reference and analysis.

- ✅ Peace of Mind: Rest assured knowing that your trucking operations are well-documented and in compliance with industry standards.

🛒 Get Your Truck Driver Log Book Today – Exclusively on Amazon!

Don’t let disorganization and inefficiency hold you back – invest in our Truck Driver Log Book and take your trucking operations to the next level. Whether you’re a solo driver or manage a fleet, our log book is your ticket to success on the road. Order now and experience the difference firsthand!

FAQ for Truck Driver Log Book Rules

1. What are the basic rules for keeping a log book as a truck driver in the United States?

The basic rules for log books in the US are as follows:

- You must drive and work within a 14-hour window.

- You’re allowed a maximum of eleven hours of driving time within this window.

- After eight hours of work, you must take a 30-minute break.

- You must have 10 consecutive hours off-duty between work cycles.

2. Do these rules apply to all truck drivers operating in the US?

- Yes, these rules apply to all commercial drivers operating trucks or buses in the US, including American and Canadian drivers.

3. How do I ensure compliance with these rules?

- It’s important to track your driving hours, breaks, and off-duty time accurately in your log book. Additionally, keep supporting documentation, such as fuel receipts, to align with your logbook entries.

4. What are the consequences of not following these rules?

- Violating these rules can result in penalties and fines. Additionally, accurate logbook keeping is crucial in the event of an investigation following a crash.

5. Are there exemptions to these rules?

- While there are exemptions, it’s essential to understand and adhere to the basic rules before applying any exemptions. Different rules may apply depending on factors such as work cycle and type of logbook used.

6. How often do I need to hand in my log sheets to my company?

- Log sheets must be handed in to your company every 13 days at a minimum. However, many companies may require log sheets to be submitted more frequently, often after each trip, for administrative purposes.

7. Can I use an electronic logbook instead of a paper logbook?

- Yes, electronic logbooks are commonly used in the trucking industry. However, ensure that your electronic logbook complies with regulations and that you keep supporting documentation as required.

8. What if I have further questions about logbook rules and compliance?

- If you have additional questions or need clarification on logbook rules and compliance, it’s recommended to seek guidance from your company’s safety department or regulatory authorities.

Why wait? Order Now on Amazon and elevate your driving experience!